TUNASET Customs Consultancy and Global Logistics Ltd. Company, which was established with the status of "Indirect Representative" within the scope of Article 5 of the Customs Law No. 4458, applies the customs rules that must be applied to the goods and vehicles entering (imported) the Turkish Customs Territory. It receives its enforcement authority from the Customs Law. It carries out the customs rules on behalf of the customers it represents. In order for TUNASET to use its power of representation, it is sufficient to issue a power of attorney on behalf of TUNASET by its customers. TUNASET also performs all formalities, such as permits, certificates of conformity, circulation certificates, certificates of origin, quotas, surveillance, etc., which must be obtained before customs procedures for some goods, on behalf of its customers. Some transactions can also be carried out after the delivery of the goods. For example, post-control applications, TRT Bandrol, License Royalties payments, determinations, etc. transactions can also be carried out later. In summary, it follows all current legislation and updates and fulfills the requirements of foreign trade in accordance with the laws.

Two actions that are sharply separated as import (entry) and export (exit) are called regime according to Customs Law. Customs declaration is used to express these regimes, this is an official document that lists the imported or exported goods and expresses their details. In a legal sense, a customs declaration is the act in which a person expresses his willingness to subject goods to a particular customs procedure. This legal procedure is described in the Union Customs Code (UCC).

It is necessary to submit a customs declaration in order to comply with legal obligations and subject the goods to customs regimes. When the goods arrive at the customs area, they will need to be subjected to a "customs-approved treatment or use". So how does TUNASET regulate the Customs Declaration? TUNASET issues the statements using electronic data processing technique. Inter-customs data processing models (Customs trans-European systems) such as EUCDM, NCTS, AES, ICS used in the EU are used. TUNASET is integrated into the NCTS application from these models.

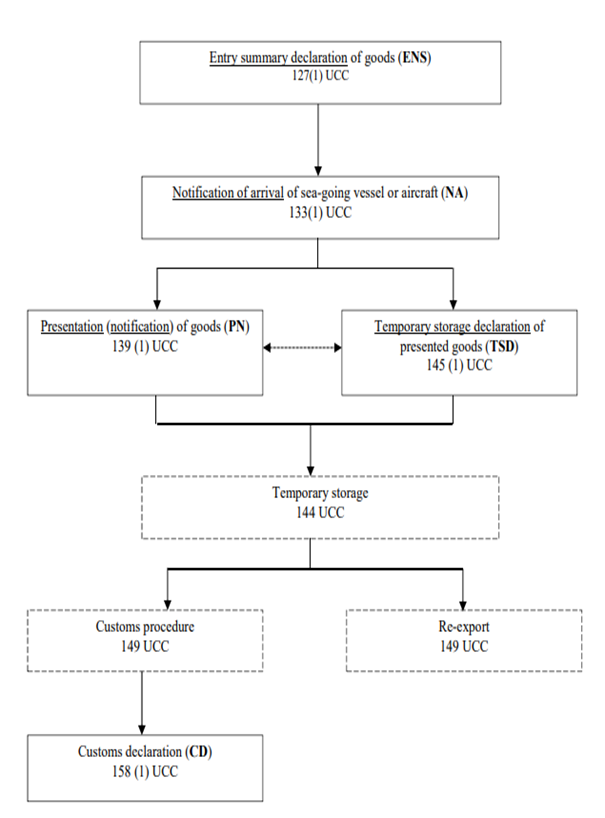

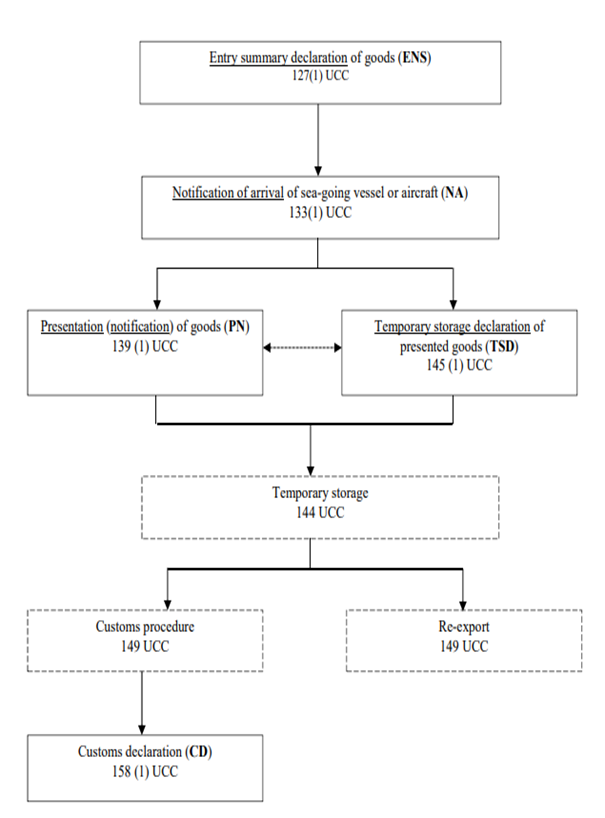

For import transactions, our workflow adapted to our Customs Law and UCC is as follows.

Below is the description of the codes;

Entry Summary Declaration of Goods (ENS) *** Entry summary declaration ***

127(1) UCC

*****

Notification of Arrival of sea-going vessel or aircraft (NA) *** Arrival notification for seaway and airway

133(1) UCC

*****

Presentation (notification) of Goods (PN) *** Presenting goods to customs ***

139 (1) UCC

*****

Temporary Storage Declaration of Presented Goods (TSD) *** Receipt of goods to temporary storage ***

145 (1) UCC

*****

Temporary Storage ***

144 UCC

*****

Customs Procedure *** Implementation of customs procedures ***

149 UCC

*****

Re-export ***

149 UCC

*****

Customs Declaration (CD) *** Issuing a customs declaration ***

158 (1) UCC

TUNASET offers service in full compliance with the EU Customs Tariff (TARIC). With the Council Regulation (EEC) numbered 2658/87 dated 23 July 1987, it has gained legal ground. In this way, a uniform application of taxes is ensured for all EU member states and Turkey, which is a signatory to the Customs Unions.

TUNASET is fully compliant with the import bans and restrictions (Prohibitions and Restrictions to import and export) set by the EU. It provides services in full compliance with restrictions and permits in the importation of ozone-depleting substances, goods within the scope of CITES, cultural assets, products and equipment containing fluorinated greenhouse gases, used goods, products that may endanger plant health, animals, etc. Directly, Iran does not trade with North Korea.

TUNASET provides service in AEO (YYS) standards. In other words, the AEO program, based on internationally accepted standards, is a partnership program between Customs administrations and economic operators.

TUNASET provides services in full compliance with customs security procedures. Following the terrorist attacks in the USA in September 2001, security considerations were included in EU customs legislation. In 2005, the World Customs Organization (WBO) adopted the SAFE Framework of Standards (SAFE). In the EU, Community Customs Law and Customs Law Implementation provisions were changed in 2005 and 2006 to include security issues. Introduction Summary Statement (ENS) has been implemented as part of the AEO authorized Operator joint risk analysis systems.

By 2010, it was aimed to improve air cargo security after detecting the cargo containing handmade explosives (Yemen Incident). This is the reason why the shoes of the passengers begin to be passed through the x-ray device. EU, international partners (USA,CANADA,WCO,ICAO,UPU) and stakeholders (IATA,TIACA,GEA,PostEurop) in the field of advanced cargo information preload (PLACI)

, KPG) has carried out extensive work with. The results of these studies have been reflected in the Union Customs Law and the implementing laws. The Import Control System (ICS) will enter into force. TUNASET undertakes to provide all national and international security procedures.

TUNASET Customs Consultancy and Global Logistics Ltd. Company, with its expert staff and solution-oriented approach since 2000, performs its services to its valued customers within the scope of the following general rules;

-Fully implements all the above-mentioned Standard Operating Procedures (SOPs),

- Performs all operations in a computerized environment, monitors and enables customers to view and follow their own operations in line with demand,

- All these transactions are carried out within the framework of Customer Satisfaction, Information Security, and all national and international Ethical Principles.