TUNASET Customs Consultancy and Global Logistics Ltd. Company, which was established with the status of "Indirect Representative" within the scope of Article 5 of the Customs Law No. 4458, applies the customs rules that must be applied to the goods and vehicles leaving (exported) the Turkish Customs Territory. It receives its enforcement authority from the Customs Law. It carries out the customs rules on behalf of the customers it represents. In order for TUNASET to use its power of representation, it is sufficient to issue a power of attorney on behalf of TUNASET by its customers. TUNASET also performs all formalities, such as permits, certificates of conformity, circulation certificates, certificates of origin, quotas, surveillance, etc., which must be obtained before customs procedures for some goods, on behalf of its customers. In summary, it follows all current legislation and updates and fulfills the requirements of foreign trade in accordance with the laws.

Two actions that are sharply separated as import (entry) and export (exit) are called regime according to Customs Law. Customs declaration is used to express these regimes, this is an official document that lists the imported or exported goods and expresses their details. In a legal sense, a customs declaration is the act in which a person expresses his willingness to subject goods to a particular customs procedure. This legal procedure is described in the Union Customs Code (UCC).

It is necessary to submit a customs declaration in order to comply with legal obligations and subject the goods to customs regimes. When the goods arrive at the customs area, they will need to be subjected to a "customs-approved treatment or use". Or, a declaration must be created for export operations to be carried out. So how does TUNASET regulate the Customs Declaration? TUNASET issues the statements using electronic data processing technique. Inter-customs data processing models (Customs trans-European systems) such as EUCDM, NCTS, AES, ICS used in the EU are used. TUNASET is integrated into the NCTS application from these models.

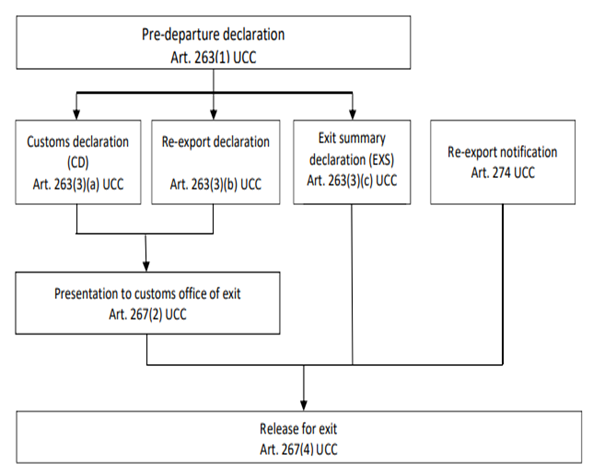

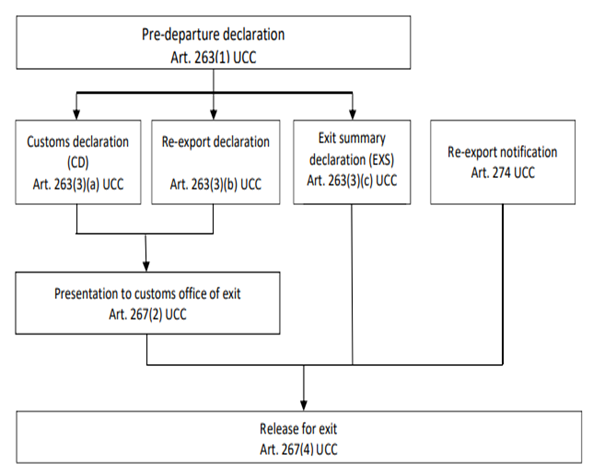

Our workflow in accordance with EU standards for export transactions is as follows;

Below is the description of the codes;

Pre-departure declaration Art. 263(1) UCC *** Pre-Departure Statement ***

Customs Declaration (CD) Art. 263(3)(a) UCC *** Issuance of Customs Declaration ***

Re-export Declaration Art. 263(3)(b) UCC *** Re-Export Statement ***

Exit Summary Declaration (EXS) Art. 263(3)(c) UCC *** Issue summary statement ***

Presentation to customs office of exit Art. 267(2) UCC *** Presenting the goods to the customs of exit ***

Re-export Notification Art. 274 UCC Release for exit Art. 267(4) UCC *** Re-export notification ***Transit Services

TUNASET offers service in full compliance with EU Customs Tariff (TARIC). With the Council Regulation (EEC) numbered 2658/87 dated 23 July 1987, it has gained legal ground. In this way, a uniform application of taxes is ensured for all EU member states and Turkey, which is a signatory to the Customs Unions.

TUNASET is fully compliant with the Export prohibitions and restrictions (Prohibitions and Restrictions to import and export) set by the EU. It provides services in full compliance with restrictions and permits in export transactions of substances that deplete the ozone layer, goods within the scope of CITES, cultural assets, products and equipment containing fluorinated greenhouse gases, used goods, products that may endanger plant health, animals, etc. Directly, Iran does not trade with North Korea.

TUNASET provides service in AEO (YYS) standards. In other words, the AEO program, based on internationally accepted standards, is a partnership program between Customs administrations and economic operators.

TUNASET provides services in full compliance with customs security procedures. Following the terrorist attacks in the USA in September 2001, security considerations were included in EU customs legislation. In 2005, the World Customs Organization (WBO) adopted the SAFE Framework of Standards (SAFE). In the EU, Community Customs Law and Customs Law Implementation provisions were changed in 2005 and 2006 to include security issues. Introduction Summary Statement (ENS) has been implemented as part of the AEO authorized Operator joint risk analysis systems.

By 2010, it was aimed to improve air cargo security after detecting the cargo containing handmade explosives (Yemen Incident). This is the reason why the shoes of the passengers begin to be passed through the x-ray device. The EU has conducted extensive work with international partners (USA, CANADA, WCO, ICAO, UPU) and stakeholders (IATA, TIACA, GEA, PostEurop, KPG) in the field of advanced cargo information preload (PLACI). The results of these studies have been reflected in the Union Customs Law and the implementing laws. The Import Control System (ICS) will enter into force. Tunaset is committed to providing all national and international security procedures.

TUNASET Customs Brokerage and Global Logistics Ltd. Company, with its expert staff and solution-oriented approach since 2000, performs the services it provides to its valued customers within the scope of the following general rules;

Fully implements all the Standard Operating Procedures (SOPs) mentioned above,

Performs all operations in a computerized environment, monitors and enables customers to view and follow their own operations in line with demand,

It performs all these transactions within the framework of Customer Satisfaction, Information Security, and all national and international Ethical Principles.